People were living longer. Thus, the shift from mortality risk to longevity risk took on renewed vigour. New products increasingly addressed retirement benefits.

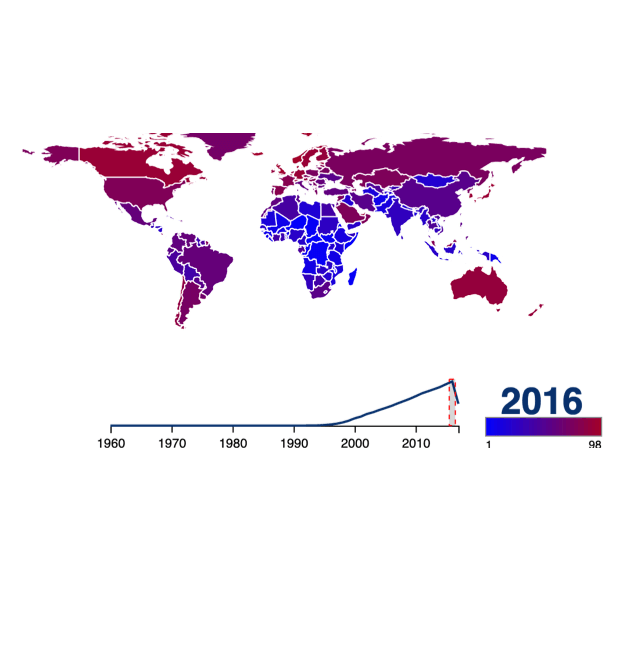

A new generation of internet businesses had also sprung up to quickly replace the wave of dot.com crash insolvencies. Small start-ups became household brands seemingly overnight. They did this by harvesting massive amounts of data and using rapid scaling strategies only possible through the power of digitalisation. Young companies like Google, Facebook and Amazon would soon become some of the most valuable worldwide brands as they permeated all aspects of our lives.

This resulted in social upheaval. Consumer behaviour, habits and expectations – especially among younger digital natives – were changing in dramatic ways. Insurers would have to begin seeing the internet not just as a promotion tool, but as a way to conduct business. People would want to have more individualised policies, faster response times and a more pleasant experience, as they had become accustomed to when using other online consumer services.