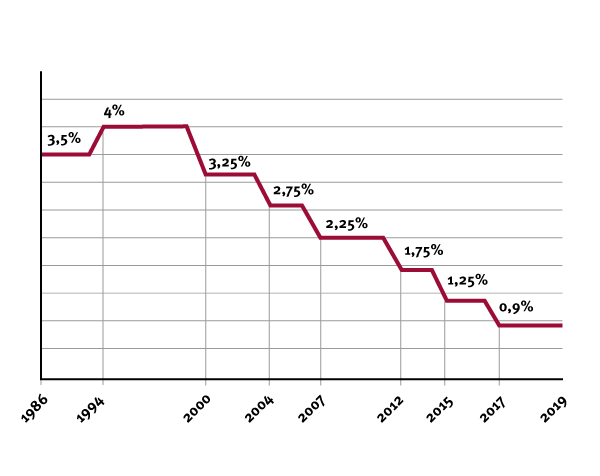

One of the biggest long-term consequences of the 2008 financial crisis became a historic drop in interest rates that have at times teetered near zero. Even the gradual economic recovery did little to change this. The negative effect on the insurance and banking industry has been tremendous. German life insurance, because of their fixed rate Kapitallebensversicherung policies carried over from previous decades, have been especially hard hit. This has spurred on a trend toward runoff business: companies sell off their poor performing portfolios to companies who are specialised in maximising administration efficiencies, and thus are able to squeeze a profit out of these policies.