Although the first computers in the 1950s were delivered without software, companies like IBM soon began bundling basic software packages with their installations. The first attempt at a standardised insurance software package was the IBM 62 CFO, which was created for its smaller 1401 machine. This was based on the consolidated functions approach developed by the American Society of Actuaries 10 years earlier (CFO stood for Consolidated Functions System for Ordinary Life Insurance). However, this set of programs was not intended for the larger firms. It was the general thinking at the time that each insurance company had its own unique needs that were best served by developing their own highly individualised systems.

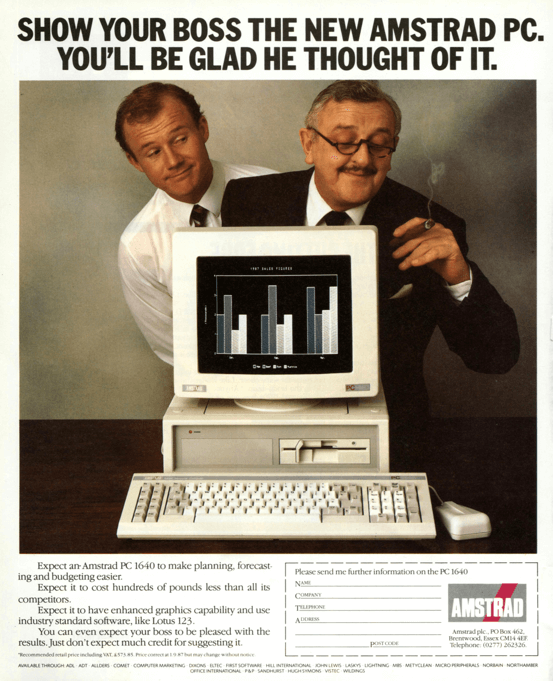

In 1970 IBM unbundled its software from its machines. This opened up an opportunity for a burgeoning new sector of independent software vendors. Simultaneously computer microchip technology was rapidly advancing. By 1980 the personal computer revolution with its new model of distributed computing was underway.

However, insurance companies had difficulty integrating the new technology. Their early adoption of information technology and their own in-house development teams had locked them into legacy core systems.