When most people think about innovation, the insurance industry doesn’t pop into their minds. Yet camouflaged behind their conservative reputation is a stunning history of information age early adoption and pioneering influence. Not only were insurance companies at the forefront of commercial computer use, but their implementation played a defining role in the path that IT technologies would take in the course of the 20th century.

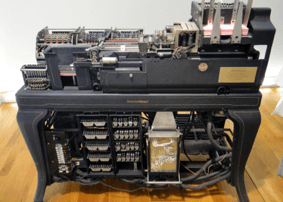

Life insurance’s dance with computers begins all the way back in 1890. The statistician and inventor Herman Hollerith had invented a device called the tabulating machine. This machine was actually a combination of electromechanical devices that used punched cards to record, sort and calculate data – what we today call data processing. In its totality, the machine was a primitive version of a modern spreadsheet program like Microsoft Excel.